Getsafe Insights H1 2018

CEO Christian Wiens about building digital insurance products under the Getsafe brand

Sometimes it’s the small things that change the game. That is why I wanted to open this post with a photo of our team of just 30 people. Only 3 of them are needed to provide great service to our 25,000 members on a daily basis. This underlines our hypothesis: In the future, the largest insurance company in the world won’t be a licensed carrier, but rather a data-driven, highly automated insurtech platform.

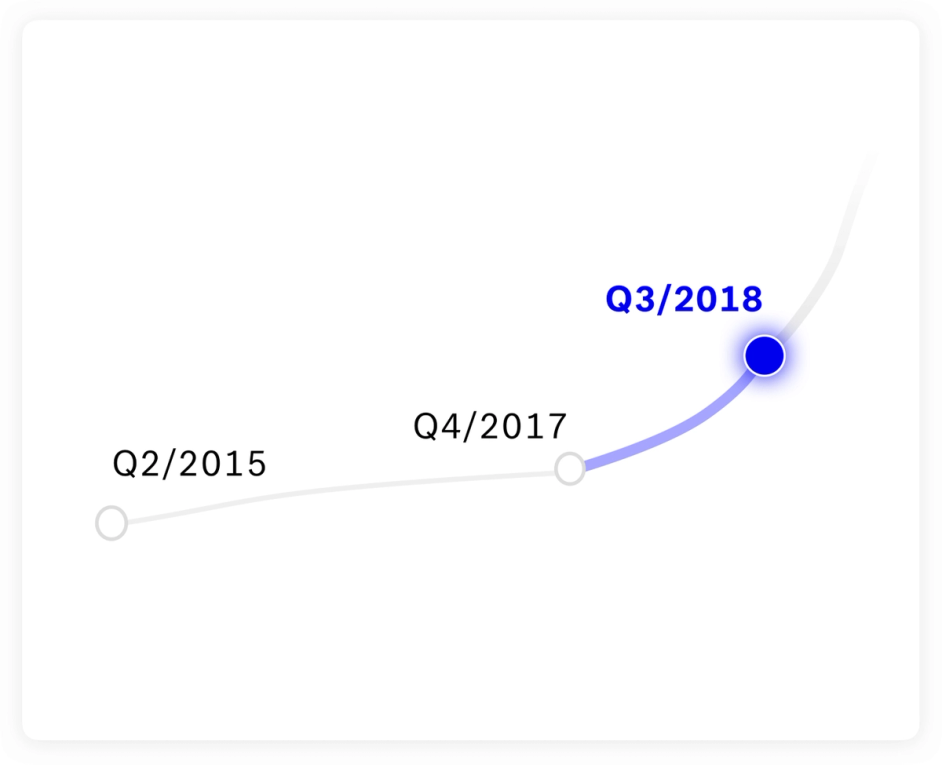

What started slowly …

In early 2015, my co-founder Marius and I had little knowledge about the intricacies of the insurance business. Still we saw great opportunity to do things better in this space and launched a mobile insurance wallet that was one of Europe’s first mobile insurance brokers. Two years later, we had reached over 20,000 customers.

We know what we do

Starting as a broker was our golden strategy. It provided us with the necessary data, insights, and industry network to develop our own insurance platform in the background. Unlike many other startups, when we finally launched our own insurance policies in late 2017, we already knew a lot about products, operations and most of all customer acquisition.

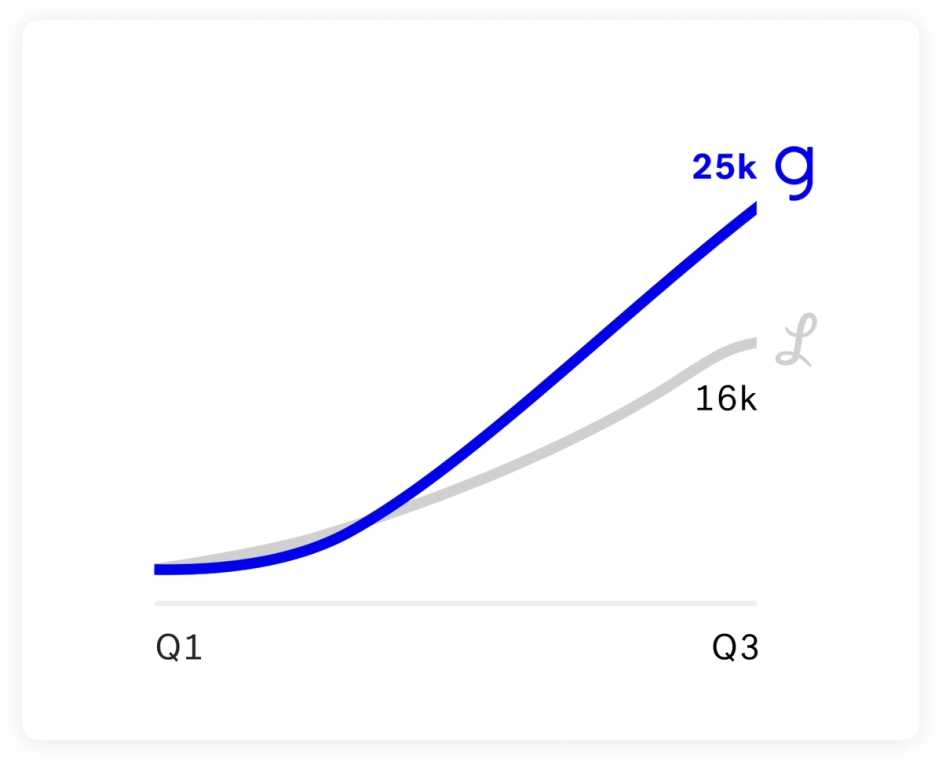

Things started off well! In just 9 months, we have attracted 25,000 new members — at a rate that is 3.3x faster than with our “old” broker app. To put our growth in perspective, we took numbers publicly available from insurance startup Lemonade. In the first three quarters on the market, we grew 56% faster.

We are the customer

Let’s take a look at our 25,000 members. They are on average 29 years old, 44% are female and 13% are expats (yes, no German insurer offers products expats are able to understand). What’s most interesting though, is that 85% of our members are buying insurance for the first time in their life. This is the audience every insurer, broker or even bank is desperately looking for. For us, it follows the most natural strategy: “Build a product for yourself ”. The demographic of our members does exactly match the one of our team.

How big is 25,000 members?

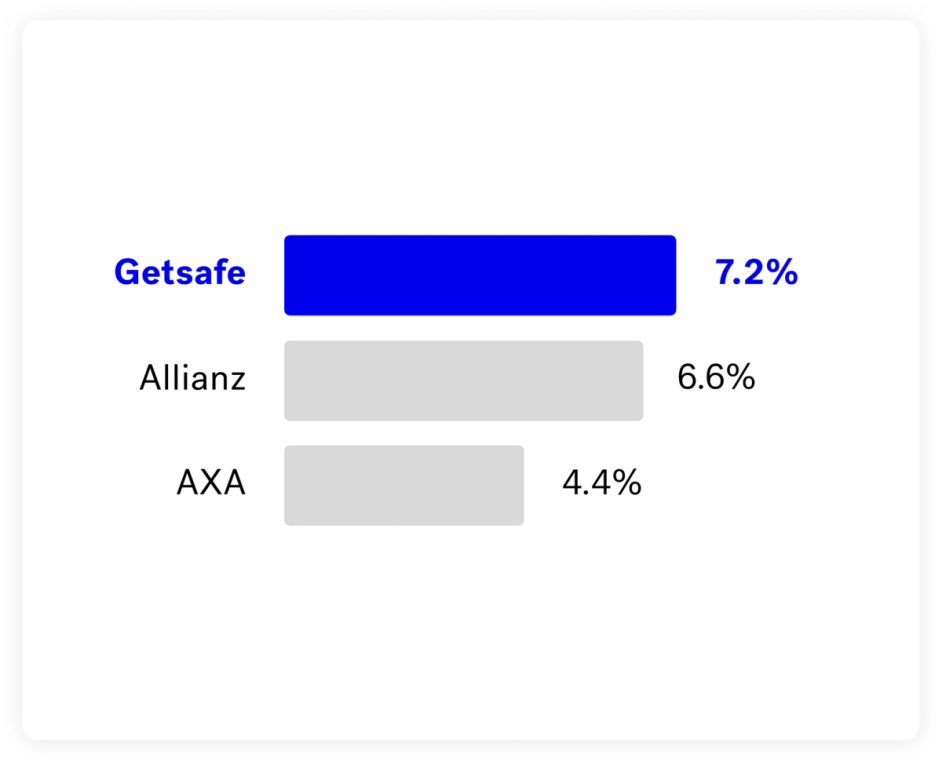

In total, we sold 31,829 Getsafe policies, with every Getsafe member buying 1.27 policies on average. In Germany alone, there are 500,000,000 active insurance policies in the market. So, do we even count? It’s a matter of perspective and the answer might surprise you.

Incumbents are struggling to reach people under 35. And if you focus on this group of customers (the so-called Millennials), Getsafe’s traction actually looks quite impressive. Just 9 months after launch, we are the #1 brand in Germany among first-time insurance buyers, with a market share of 7.2%. Followed by giants like Allianz and Axa.

Automation vs. NPS

Here is where the power of our technology becomes most visible. Take our 31,829 policies divided by 29, the current number of our team members. What you get is a KPI that helps comparing the Level of Automation of insurance companies. How many humans are involved to service your customers? We calculated it for the largest incumbents in Germany and the numbers speak for themselves.

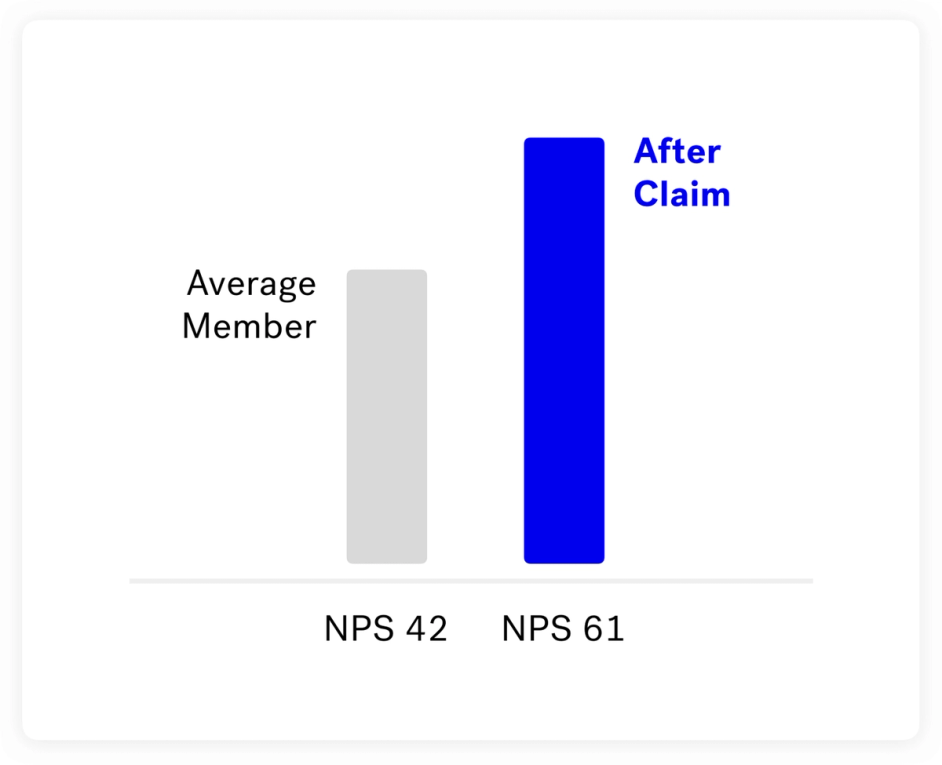

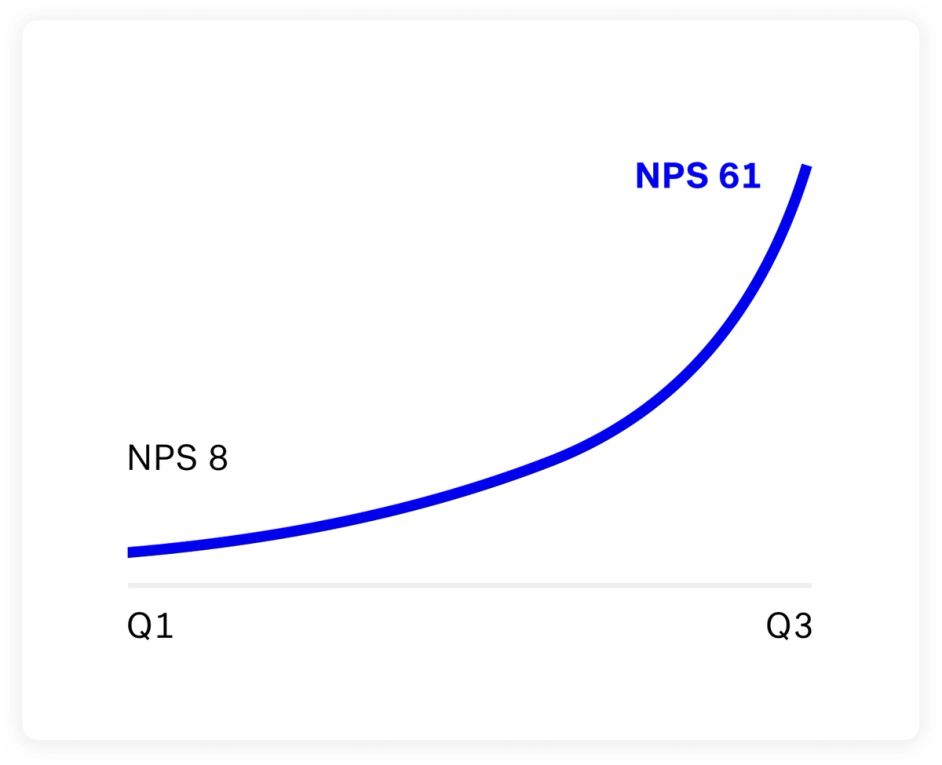

Your initial reaction probably is: Shouldn’t providing less human resources in customer service have a negative impact on the happiness of customers? We see the opposite and to prove this, we constantly measure our NPS (Net Promoter Score) as a KPI for customer happiness. Our average NPS is 42. Members who have filed a claim with our AI even have an average NPS of 61. This underlies what in my opinion most players in the market are still getting wrong: Automation isn’t about reducing costs. It’s about making insurance fast and enjoyable.

Claims is where you win or lose

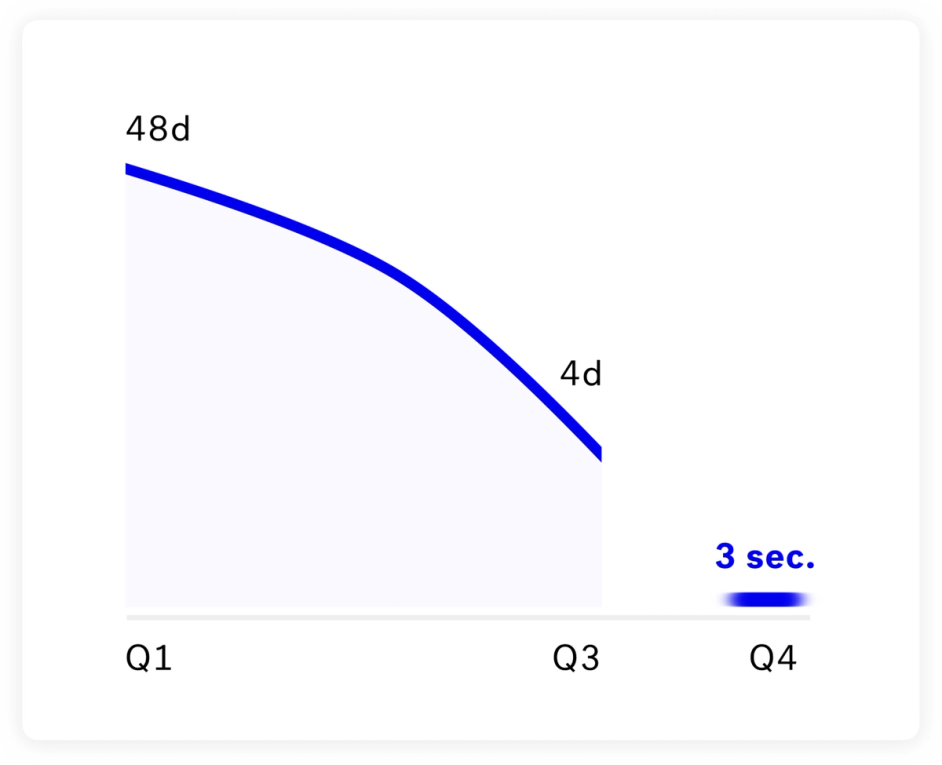

While we started with plenty of experience in acquiring customers and selling insurance, regulating claims was something new for us. And to be honest, in the first 6 months, we really struggled to be good at it. With our operations not yet running so smoothly, some of our members had to wait up to a month or more to receive their money. As a logical consequence, our NPS for members who filed a claim was below 10.

Our members were rather unhappy when they filed a claim with us, which in turn told us that we had not yet reached our core value proposition. To turn things around, we decided to make claims the number one priority in our company. By August 2018, our members on average had to wait 3.1 days for receiving their money after filing a claim. And this month we introduced fully automated claims for a common claim category. In some cases, it now takes as short as 3 seconds to get your money back from us.

An outlook: Uber doesn’t own the cars

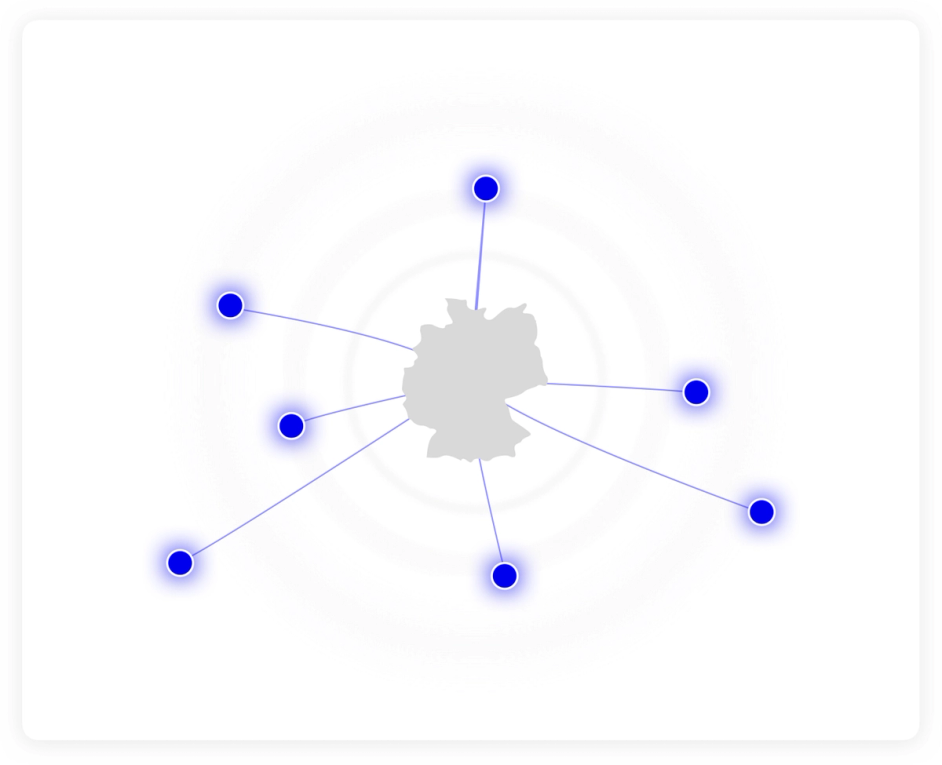

Getsafe is built to be a global insurance platform. We offer a one-stop shop insurance app, that delivers an instant, consistent, and as we like to believe: great! insurance experience. As we have built all relevant backend and administration systems from scratch, almost every transaction, from underwriting to claim, is automated. In doing so, we’re collecting new data sources that will enable us to better predict loss ratios and develop new underwriting algorithms.

So, how are we different? We don’t own insurance licenses. Instead, we partner with licensed carriers and together with them build digital insurance products under the Getsafe brand that all follow the same standards. Our partners dock onto the Getsafe platform and manage regulation and risk underwriting, Getsafe provides the customer base and everything else — including tech, customer service, claims, marketing, quote & bind, etc. That makes us fast and flexible, ready to expand into new product lines and markets at a speed that has not been possible before.