Getsafe launches in Austria

Digital insurer Getsafe is launching three new products in Austria. As of today, customers can take out liability, household, and dog owner liability insurance. Getsafe used its insurance license for the expansion for the first time.

“Thanks to our platform, we can enter a new market within a few months – it only took us eight weeks to launch in Austria,” says CEO and founder Christian Wiens, and continues, “I am proud of the entire team. For Getsafe, this proves the power of our technology, and it is a blueprint for further market entries.”

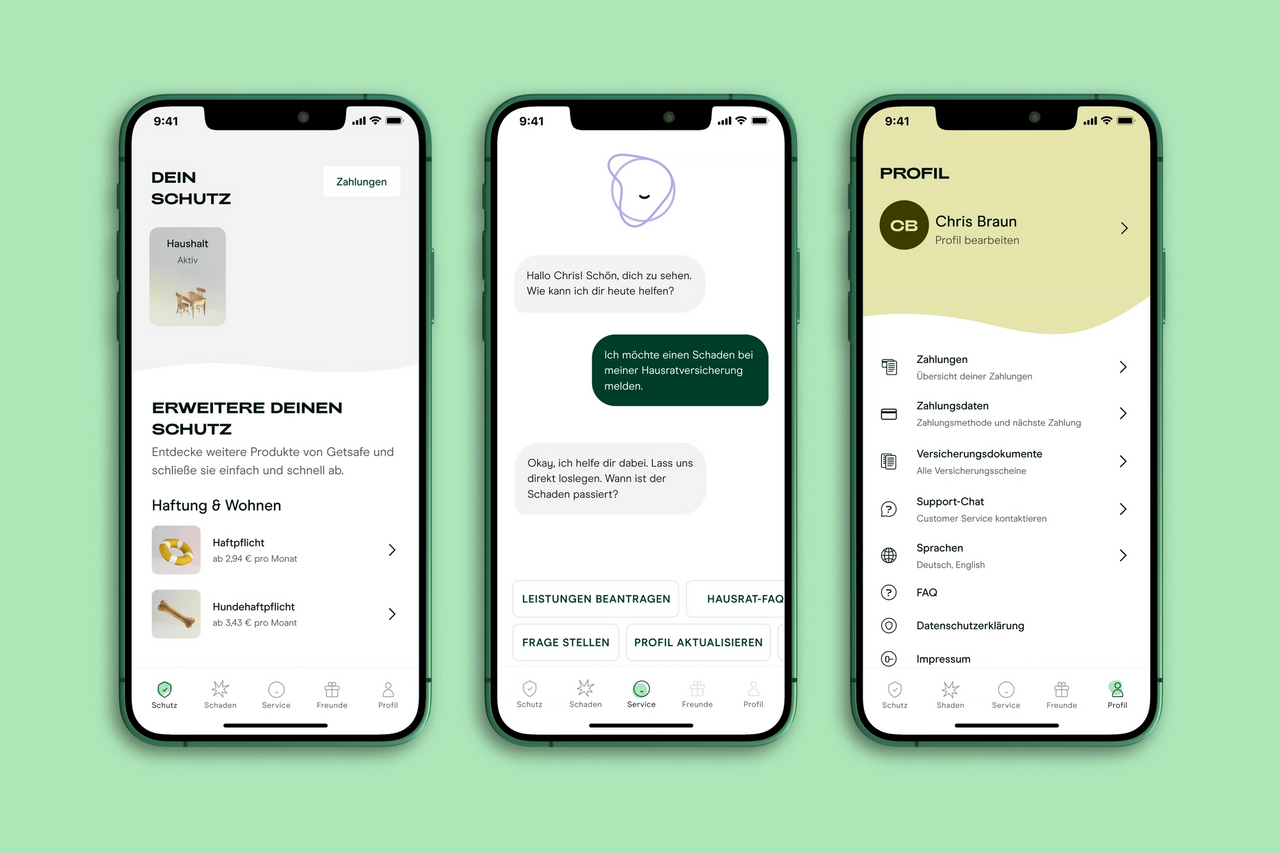

Customers in Austria benefit from an end-to-end digital insurance experience, allowing them to change their coverage in real-time with just a few clicks. They can even file claims and track the status of their claims via a smartphone app. In this way, Getsafe not only makes insurance digital and paperless, but instead pursues a mobile-first approach to insurance in general. Getsafe developed the products based on the needs identified by Austrians. In addition to personal conversations and surveys, direct feedback from the app was also incorporated into the product.

Christian Wiens says: “Today, Getsafe is already the best-rated insurance app in Germany for digitally savvy people. Now we want to repeat this success in other European countries.” In the future, Getsafe wants to be the app to go to for all things regarding personal insurance.

Demand from customers is high. The pandemic, volatile financial markets and inflation, and the dramatic geopolitical situation have increased people's need for protection and provision, especially through digital channels. There is another peculiarity for young people belonging to the millennial generation and Gen Z: they have realised that they should take financial precautions and not just rely on state protection. At the same time, the financial crisis and scandals such as the Wirecard affair have damaged these people's trust in banks and traditional insurers.

In the coming months, the company will be working on further products for the German market as well as the target markets of France and Italy, for which Getsafe applied for licenses from the German Federal Financial Supervisory Authority (BaFin) in March of this year. Getsafe also plans to operate as an insurer in these markets, starting with simple property and casualty insurance products such as home insurance.

Since the beginning of the year, Getsafe has been working with partners to offer products in employment protection and health insurance. Christian Wiens explains, “Neobanks and neobrokers offer contemporary apps for mobile banking transactions and stock trading. They are part of the solution but not enough to adequately protect young people, in particular, against old-age poverty and other risks. We see daily that insurers continue to play a major role here. This makes us confident that we can build a strong life and health insurer in Europe.”

Most recently, Getsafe added buildings insurance for customers in the United Kingdom (UK), completing its offering for homeowners. The UK market already accounts for 25 per cent of Getsafe's growth. The company now has over 50,000 UK customers. With over 100 million euros in venture capital and over 300,000 customers, Getsafe is one of the largest European insurtechs.

ABOUT GETSAFE

Getsafe is a digital insurance company creating a better insurance experience for everyone that is easy, flexible, and enjoyable. With its strong technological backbone, the company offers liability, contents and car insurance in Germany and contents insurance in the UK. Getsafe replaces complexity and manual paperwork with smart bots and automation, allowing customers to file claims or change their coverage in real-time with just a few clicks.

Since launching in 2018 in Germany, Getsafe has expanded to the UK and is now looking into further European markets. The company is headquartered in Heidelberg, Germany, with offices in London and Berlin, and employs more than 150 people. In 2021, Getsafe received its insurance license from Germany's financial regulator, BaFin. With $116 million raised to date and serving over 300,000 customers, it is one of Europe’s top 10 funded insurtechs.

Learn more about Getsafe on our website or LinkedIn and Twitter.

PRESS CONTACT

Dr. Lydia Prexl

phone: +49 151 555 69 709

email: l.prexl@hellogetsafe.com