Getsafe Launches Buildings Insurance in the United Kingdom

Digital insurer Getsafe is launching its new buildings insurance to complete its home insurance proposition in the United Kingdom. This underlines Getsafe's commitment to the British market. The company just hit the 50,000 customer mark in the UK and continues to grow its position as Europe's leading neo-insurer.

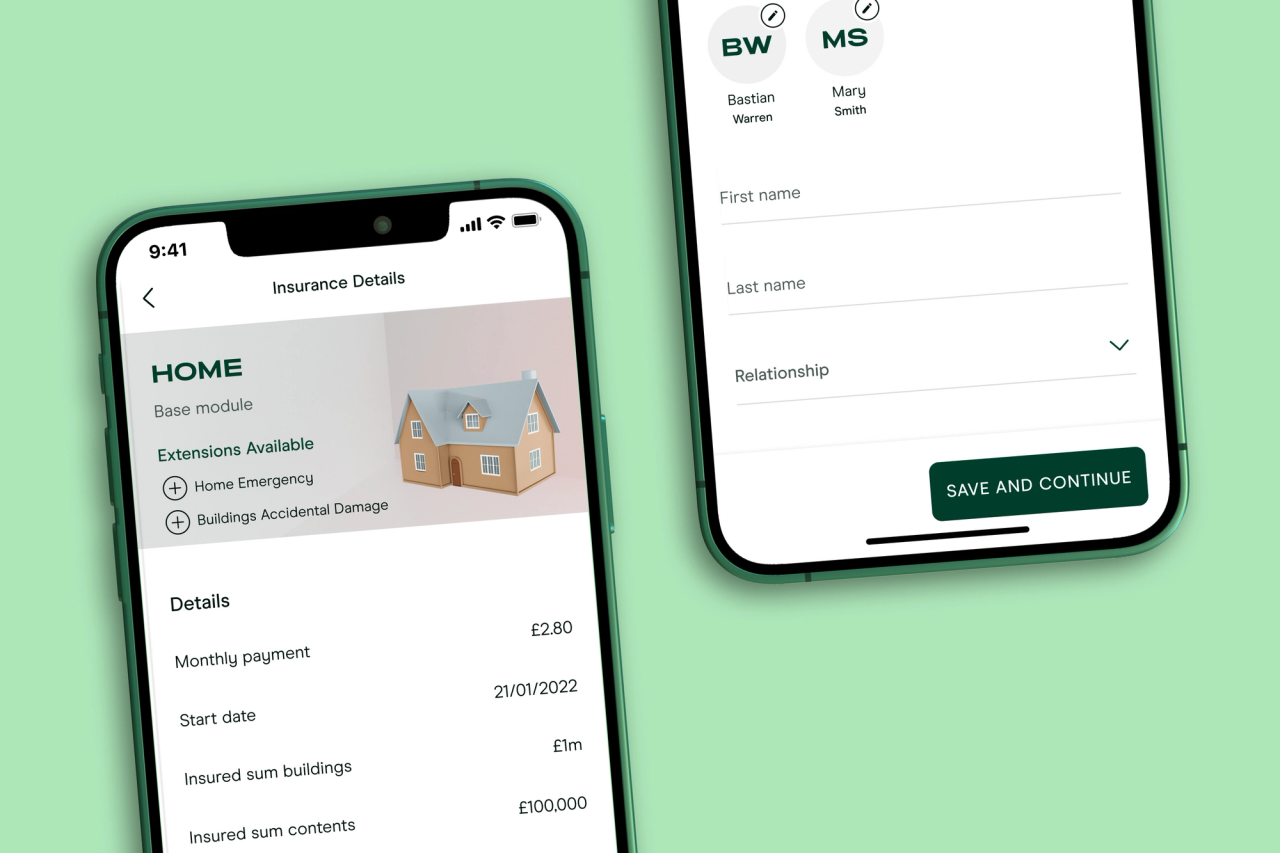

Following its successful growth in the British market, Getsafe is expanding its portfolio and introducing its digital buildings and contents home insurance product. The new product bears much of the DNA which has made Getsafe so popular with the Millennial generation: Instead of a fixed contract with rigid terms, Getsafe offers a flexible insurance subscription that people can customize to their needs and cancel on a daily basis without admin fees. This allows customers – especially younger homeowners – to select the cover they need for their property and avoid paying for irrelevant packages.

63 % of the British population owns a home, which makes Getsafe’s new home insurance not only relevant to many people, but also to younger ones. This is why Getsafe chose to launch its product first in the United Kingdom, addressing an important security need for the majority of the population.

Christian Wiens, CEO and co-founder at Getsafe comments: “At Getsafe we believe that the world deserves better insurance. So we put together insurance that is transparent, accessible and fair. Helping thousands of customers to manage their insurance without any paperwork or hassle, in just a few seconds, all from their phones with just a tap. With this mobile-first approach, we are developing a product that perfectly meets the demand of a young, tech-savvy generation.”

Getsafe has set out to become the one-stop solution for all people who want to manage insurance via smartphone. Already more than one quarter of Getsafe’s total growth is generated through the British market. Christian Wiens says: “In the past six months, we more than doubled our customer base to now 50,000 in the UK alone. With our new product, we expect to double our growth rate again.“

Founded in 2015, the insurtech began as a digital broker, then pivoted to develop its own digital insurance products as a managing general agent. In 2021, Getsafe obtained its own insurance licence for Germany and the European Union, allowing the company to control the full value chain and to innovate even faster. Currently, Getsafe employs 170 people at three locations and serves more than 300,000 customers. In the following months, Getsafe plans to expand its operations to markets in France, Italy and Austria.

Christian Wiens comments: “The pandemic has accelerated the adoption of digital insurance solutions. Especially digital-savvy target groups are used to doing everything via smartphone – this includes banking and trading, and it also includes insurance. Thanks to our platform, we replace complexity and manual paperwork with smart bots and automation, creating a better and faster insurance experience for everyone. We want to build one of Europe’s leading digital insurers, and we are just getting started.”

ABOUT GETSAFE

Getsafe is a digital insurance company that creates a better insurance experience for everyone. Powered by its unique technological platform, Getsafe makes insurance simple, fair and accessible for everyone. As Getsafe replaces complexity and manual paperwork with smart bots and automation, customers can file claims or change their coverage in real time with just a few clicks.

Since launching in Germany in 2018, Getsafe has become one of the best-rated insurtechs in Europe, serving over 300,000 customers. After having started its UK operations in 2020, Getsafe is now looking to expand in order to serve even more European markets. Headquartered in Heidelberg, Germany, with offices in London and Berlin, the company employs 170 people. In 2021, Getsafe received its insurance licence from Germany’s financial regulator, BaFin. With $116 million raised to date, it is one of Europe’s top 10 funded insurtechs.

Learn more about Getsafe on our website or on LinkedIn and Twitter.

PRESS CONTACT

Dr. Lydia Prexl

phone: +49 151 555 69 709

email: [email protected]