Getsafe Insights H2 2018

The first year after the launch of our insurance company comes to an end

The first year after the launch of our insurance company comes to an end. And without a doubt, it was the most exciting year we at Getsafe ever had! If you are a strategy-person, read on, for the numbers, head to the last paragraph.

Here’s what you’ll learn:

- Getsafe’s broker unit was sold to Verivox to fully focus on being a mobile-first insurance company

- CARL is the name of Getsafe’s proprietary infrastructure, now covering all parts of the insurance value chain

- Getsafe reaches insurance customers before anybody else with a low-premium product they really need

- 47,200 Getsafe polices were sold in 2018. 1 out of 5 customers found Getsafe organically through Word of Mouth

Leaving the “digital broker to insurance company”-journey behind

If you’ve been following Getsafe for some time already, or read our H1 2018 insights, you know that Getsafe started out as a pioneer in German insurtech, establishing a digital broker in 2015 to then add operations as an insurance company in 2017.

In September we sold our brokerage unit to Verivox, one of the top 2 aggregators in Germany. This was a significant step emphasizing our long-term strategy of building an insurance company for the next generation.

Working as a broker helped us to deeply understand modern customer expectations in insurance and to identify the parts of the insurance value chain we need to rebuild from scratch in order to meet and exceed these expectations.

While many fellow insurtechs block vast resources to obtain and maintain their own carrier license, we don’t take risk on our books. We believe this part of the value chain requires a lot of traditional, regulation-heavy expertise and isn’t a key differentiator (yet) — also refer to our CFO’s blog “the two breeds of digital insurance”.

Besides that, we are now covering all essential parts of the value chain with our proprietary technology platform “CARL” consisting out of a marketing platform, policy admin system, underwriting engine and claims processes. “CARL” serves as a great partner to our customer-facing chatbot “CARLA”.

This regulatory and technological setup allows us to navigate the complexity of insurance rules in any market like riding on rails, which resonates well with our Germany-rooted efficiency-culture that also recent exciting international hires like our VP Product, ex-Uber Patrick Tsao, pick up in no time. Insurance, it’s showtime!

Reaching insurance customers before anybody else

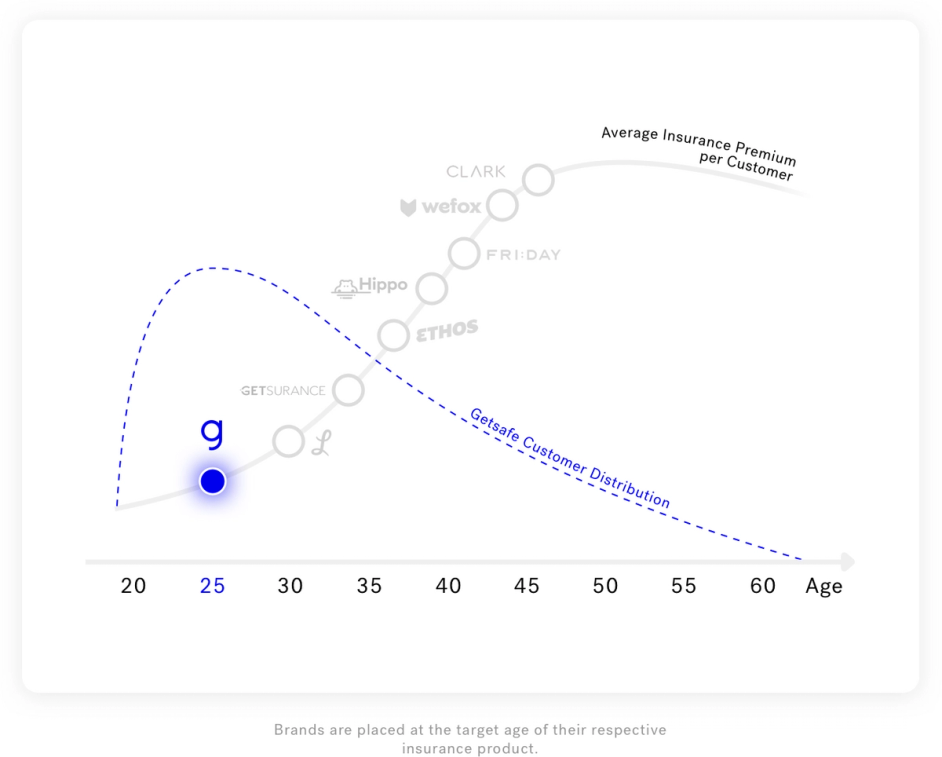

Have you ever heard about the Insurance Customer Lifecycle? This is an important perspective on how insurance premium per customer develops by age.

In fact, it develops like an S-shaped curve, starting with low insurance spend for customers in their 20s, accelerating around 30 when people gather more meaningful things they want to protect like family, children, houses and cars and then saturating for customers aged 40+.

This doesn’t just apply to Germany, but can be found in all mature insurance markets. In order to build this curve, we analyzed insurance premiums of more than 100,000 insurance policies from over 20,000 customers of all ages that we collected as a broker.

Getsafe is perfectly positioned to capture customers at the very beginning of the insurance lifecycle in any market with a strong peak of our customers being 25 years old. Why do we think this is so valuable?

Solving a problem

Young people need insurance more than anybody else. They are new to the job market, have no or little financial education and frequently more debt than savings. Being uninsured makes them particularly vulnerable to the financial consequences of loss or damage. Providing them easy access to insurance with intuitive products solves a real problem.

Lock-in effects

One reason why we love insurance as a business is that it is very sticky by nature. When you try to attract older, well insured people as customers this obviously poses a challenge. Instead of convincing consumers to switch their carrier (quite often driven by strong competition on price), we believe it is much more sustainable to focus on uninsured people and create long-term lock-in effects.

Data

We believe that if you start an insurance company today, data is worth more than written premium. That’s why we target a young demographic with a low-premium product they really need first. This leads to sustainably low acquisition costs and more customers (=data) you can acquire. Even more important, young customers are digitally savvy and adopt technology much faster. As a mobile-first insurance company this again produces much more new data that has the potential to re-invent traditional methods of underwriting.

Growth

Almost 50,000 Getsafe insurance polices have been underwritten since launching our liability insurance one year ago. This looks like a tiny number in a market of ~500,000,000 insurance policies on 83,000,000 inhabitants.

But taking a closer look, in our first year in the market, we already obtained a market share of around 10% among the 24–29 year old insurance starters. This is an exciting group of previously uninsured customers buying insurance for the first time. In H2, we managed to grow even faster than what we celebrated in our H1 2018-post, making us the fastest growing insurance brand in the millennial generation in Germany.

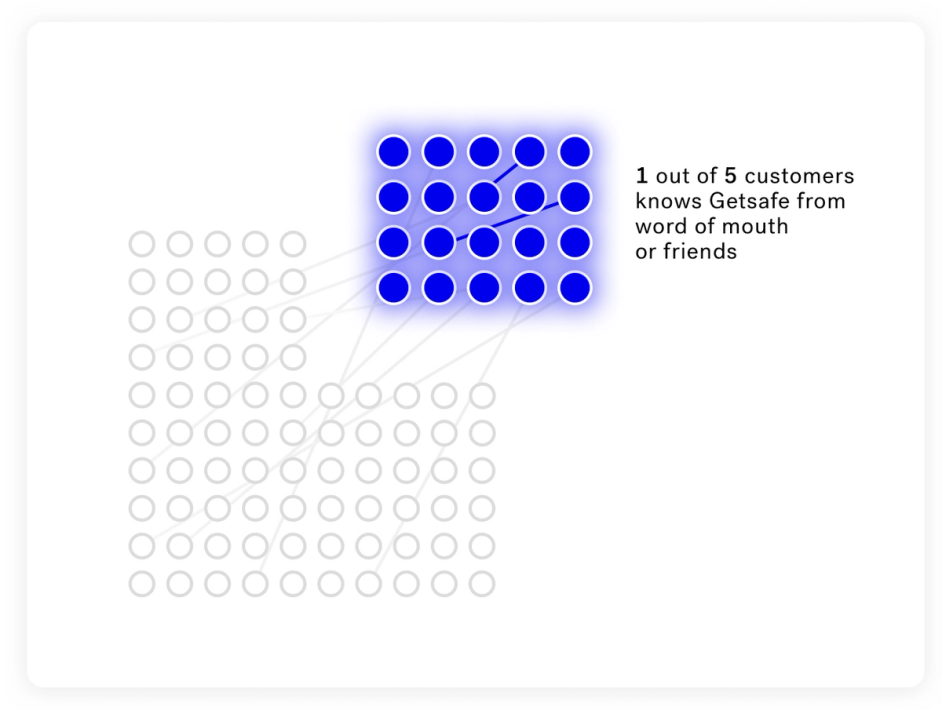

Even more interesting than our absolute growth though is that 1 out of 5 customers found Getsafe organically.

Of course, this doesn’t happen overnight. We invest a lot of time and effort in building a proprietary network of relevant partnerships, e.g. in the university ecosystem. This already includes >100 partnerships in Germany, where Getsafe mostly acts as an exclusive insurance partner. Again, the benefit of solving a specific problem for a group of customers is obvious. Young people all face the same challenge of buying insurance for the first time and tend to use social media much more to share useful tips and interesting content.